Award-winning PDF software

How to respond to employment verification Form: What You Should Know

We have reviewed [Employee's name's] work history and information, and have concluded that (Employee's name) would be a good fit for (Company/Institute/Project name). [Employee's name's] new position shall be permanent. Upon hiring [Employee's name], we will ensure that [Employee's name] can continue with your company. I am happy for [Employee's name] to serve your organization well. Respectfully yours, The company. For the record, that company isn't a big bank—it's a big government, with a big government sector, which is the state sector (the part of government that's in direct control of the government sector, which is the government that's in control of the economy). Government has many functions, and some are more visible, like defense. One part of government that's invisible is the government sector that's directly connected to the government — the part of government that's responsible for enforcing tax law (as opposed to enforcing contracts, which is how the IRS is funded). When the government sector enforces contracts, the IRS gets a lot more revenue. That's why the IRS is funded. It's also why the federal government's not allowed to issue credit cards, because the government sector issues credit. In other words, the federal government acts directly in the economy. Government does not “impose taxes” so much as impose costs. The government sector enforces contracts because there's the need to fund the government sector. And the government sector enforces contracts because that way the government sector gets a lot more revenue. There's an even bigger reason. If the government sector imposed the full cost of its tax collection, it would go broke. There'd be some people who had the means and the ability to pay, but most people don't pay the full cost of their taxes, the full cost of running the government. The government sector knows that by taxing us, it's going to get a lot of revenue, and the government sector enforces contracts by collecting that revenue, which gives it an incentive to raise the tax rate on us. And if you don't pay the full cost of the government sector, you won't have any contracts. The government sector knows that by not enforcing contracts and levying the full cost of fees, it'll have a great deal more revenue than it does today.

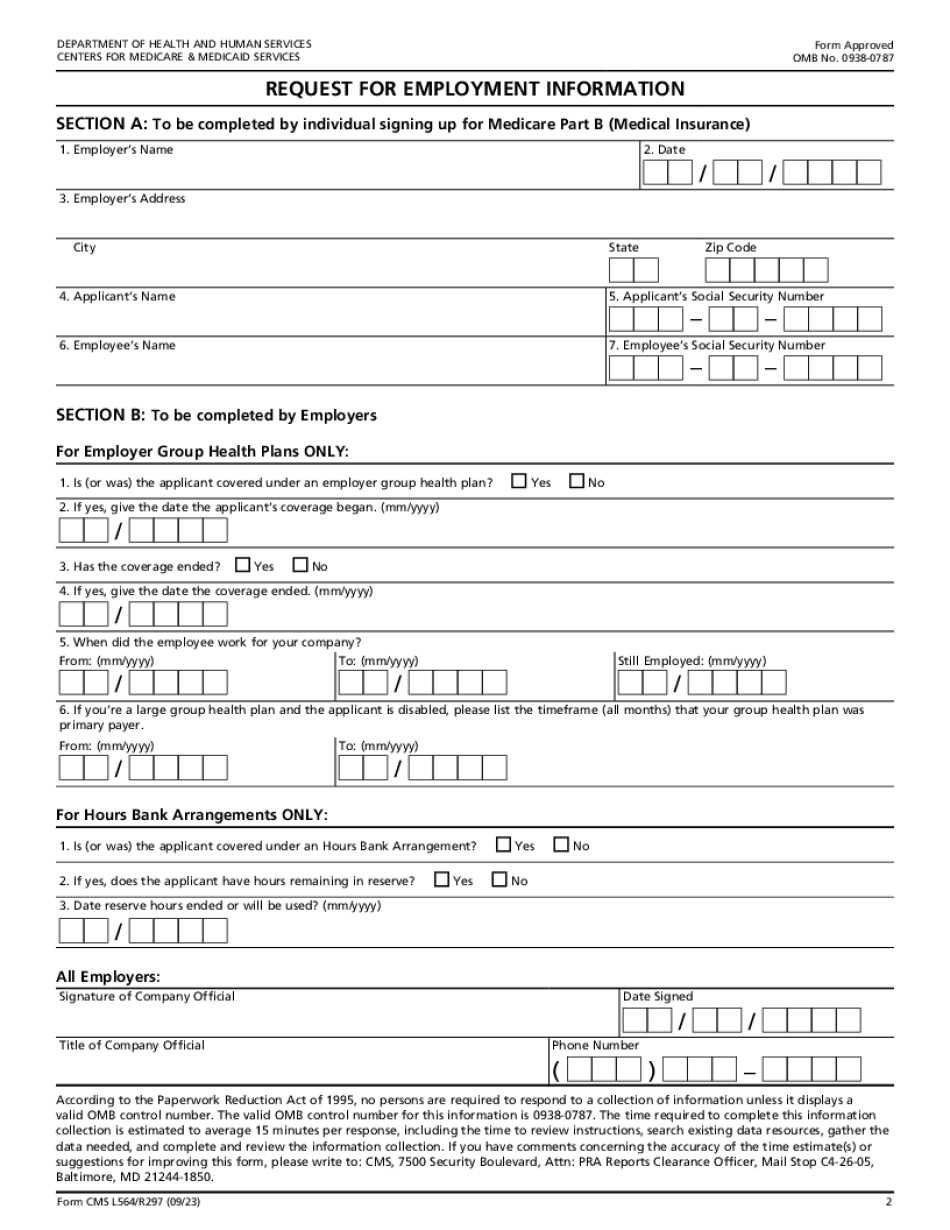

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do CMS-L564, steer clear of blunders along with furnish it in a timely manner:

How to complete any CMS-L564 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your CMS-L564 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your CMS-L564 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.