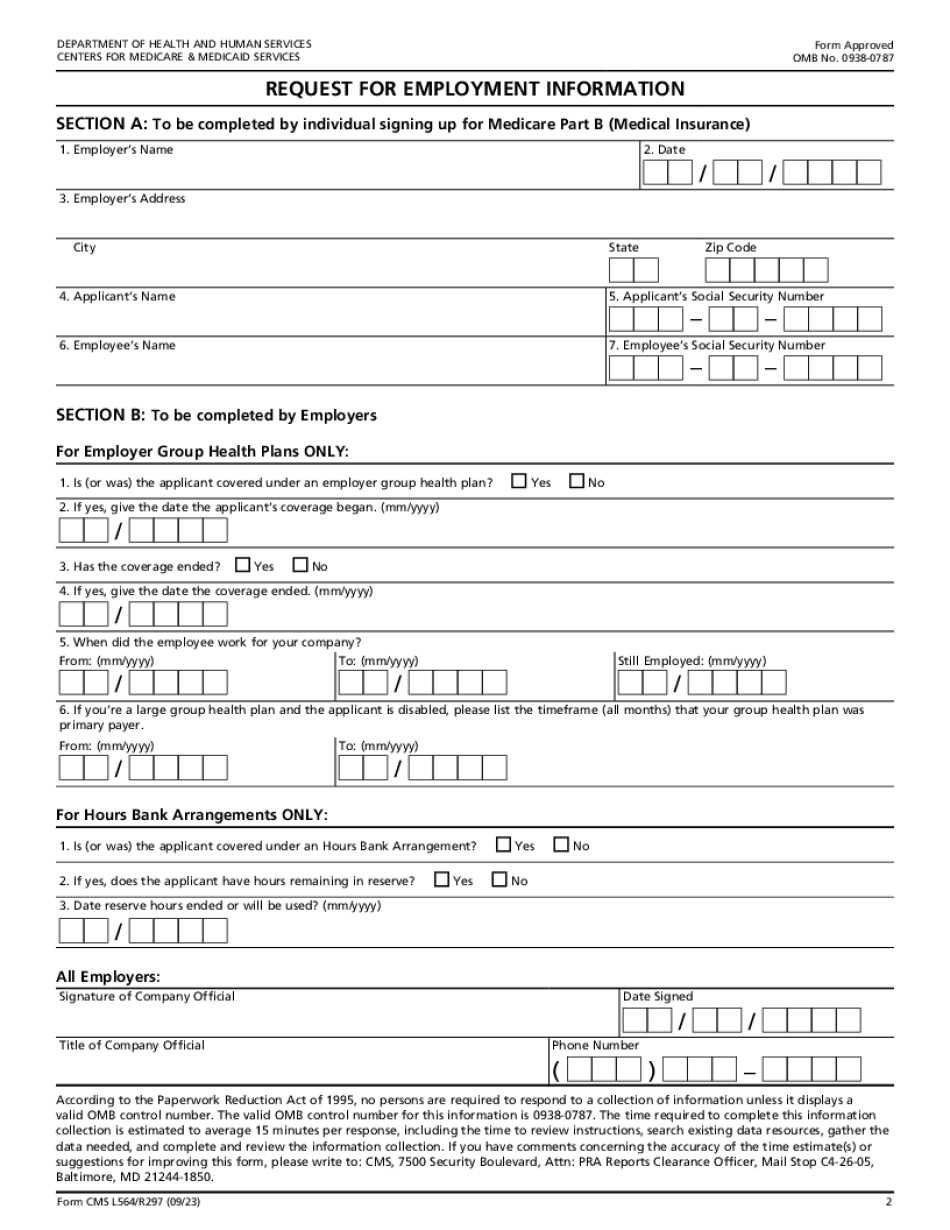

If you're enrolling in Medicare Part B after turning 65 and you're coming off a group health plan based on your current employment or your spouse's current employment you need to know how to fill out form CMS l564 coming up next we'll show you how to fill out the form without any mistakes watch our previous video how to complete form CMS 40b which enrolls you in Medicare Part B but you need both form 40b and form l564 to complete a special enrollment period application for Part B we'll link to that at the end as well as in the video description below now remember a special enrollment period is when you'll be on the seven month initial enrollment period for Medicare and you're coming off a Group Health Plan through your employer or your spouse's employer to avoid a late enrollment penalty you need to submit the application while covered on the group plan based on current employment or during the eight months immediately after separating service from the employer you need to submit both form 40b and form l564 to your local SSA office to apply for Medicare Part B in this scenario both forms can be downloaded from ssa.gov forms here's form l564 the request for employment information there are two sections section A and section B mistakes are commonly made in a few spots which ultimately delays the processing of your application here's how to get it right an important note you need one form for each person enrolling in Part B so if it's a married couple signing up at the same time both need a completed form l564 yes even if one spouse is not working the non-working spouse's coverage is through the working spouse's employment so Social Security needs verification...

PDF editing your way

Complete or edit your cms l564 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export cms l564 form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form cms l564 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your social security administration form cms l564 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about CMS L564

- Form Approved OMB No* 0938-0787 Expires 10/2024

- To be completed by individual signing up for Medicare Part B Medical Insurance

- People with disabilities must have large group health plan coverage based on your your spouse s or a family member s current employment.

Award-winning PDF software

How to prepare CMS L564

About CMS-L564

CMS-L564 is a form used by the Social Security Administration (SSA) to verify an individual's enrollment in a Medicare Part B program. It is officially titled "Request for Employment Information" and is required for individuals who are still working and have health insurance coverage through their employer. This form serves as proof of such coverage and is necessary for the SSA to properly determine an individual's eligibility for Medicare benefits. It is important for individuals nearing age 65 to complete this form as part of the process of enrolling in Medicare.

How to complete a CMS L564

- Then, take the form to your employer for them to fill out Section B

- Make sure to include the completed form with your Application for Enrollment in Medicare CMS40B and send both to your local Social Security office

- For help with completing the form, call Social Security at 18007721213 or visit your local Social Security office

People also ask about CMS L564

What people say about us

File paperwork in time with a reliable web-based solution

Video instructions and help with filling out and completing CMS L564